high demand for luxury watches

Luxury watches are in demand as alternative investments. The explosive development of the luxury watch market over the past 10 years has created a $22 billion secondary watch market. Buyers are willing to pay significant premiums for preowned models from renowned brands like Rolex, Patek Philippe, and Audemars Piguet, as well as from notable independents such as F.P.Journe, anticipating a continued increase in their value.

How it works

1. Buy

We define your Investment size & time horizion and help you curate a portfolio that fits your financial goals

2. Hold

Keep the watches securely stored in Investment Watches' highly protected environment, or select your own preferred storage option during the agreed investment period

3. Sell

You can either sell the watches through our commission terms, extend the investment period, or retain the watches for personal use or further investment

Why watches are a great investment

Luxury watches offer the advantage of being tangible assets that investors can hold, display, and enjoy. Unlike stocks or real estate, which may require complex ownership structures or maintenance, luxury watches are relatively easy to store, transport, and liquidate when needed. Investing in luxury watches can provide diversification benefits to an investment portfolio. Since luxury watches often have low correlation with traditional asset classes such as stocks, their value may not move in tandem with broader market trends. By adding luxury watches to a diversified portfolio, investors can potentially reduce overall portfolio risk and enhance long-term returns.

Tangible asset

Luxury watches offer the advantage of being tangible assets that investors can hold, display, and enjoy. Unlike stocks or real estate, which may require complex ownership structures or maintenance, luxury watches are relatively easy to store, transport, and liquidate when needed. Investing in luxury watches can provide diversification benefits to an investment portfolio. Since luxury watches often have low correlation with traditional asset classes such as stocks, their value may not move in tandem with broader market trends. By adding luxury watches to a diversified portfolio, investors can potentially reduce overall portfolio risk and enhance long-term returns.

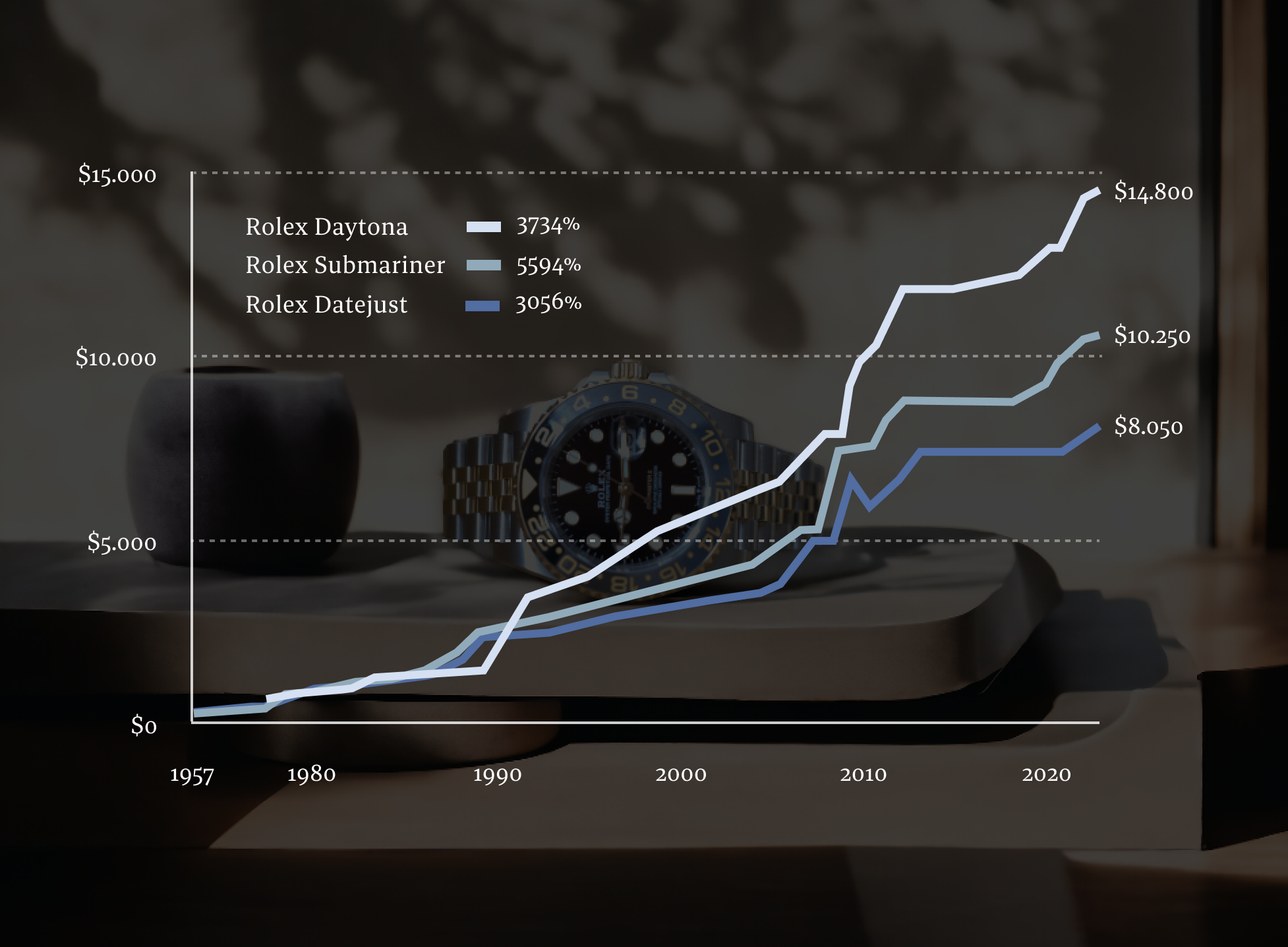

Strong historical increase in price

The prices of top models from Rolex have been increasing for the past 67 years. Furthermore, the Chrono24 price index of Patek Philippe, Audemars Piguet & Rolex have increased in the past 5 years

Need help?

Frequently Asked Questions

You can opt to keep the watches securely stored at Investment Watches in a highly protected environment, or you have the freedom to select your preferred personal storage option.

Insurance coverage is provided for stored portfolios. However, if you choose to store your portfolio, you will be responsible for procuring insurance.

We provide investment opportunities in a wide array of luxury watch brands, including renowned names such as Rolex, Patek Philippe, and Audemars Piguet. Additionally, we offer options for investment in alternative luxury watch brands such as Richard Mille, Vacheron Constantin, F.P. Journe, and Cartier. Our experienced team will expertly guide you through the investment process, leveraging our proven track record in the industry.

The quantity of watches within your portfolio is contingent upon the scale of your investment. Our objective is to ensure that multiple timepieces are included in each portfolio.

To optimize returns, we advise a minimum investment period of two years for investments in luxury watches. Our portfolio options typically span investment periods of 2, 3, 5, or 10 years. Upon the expiration of the initial period, portfolios may be extended as desired.

You have the flexibility to withdraw from your portfolio investment at any time. However, should you choose to do so within the investment period, you will forfeit your entitlement to the guaranteed appreciation. If you decide to exit the portfolio investment during the investment period, you have the choice to either retain the watches or allow us to assist you in selling them at market price.

When your portfolio is stored with us, it remains accessible for viewing on our premises; however, removal is only permitted upon termination of the agreement. Alternatively, if you choose to store the watches yourself, you retain full access rights. It's imperative that the watches maintain their condition to ensure the activation of the minimum buyback value.

Yes. Portfolio investment can be made by companies or private consumers.

Upon conclusion of the investment period, the buyer is presented with four options:

- Sell the watches at the optimal price, facilitated through Investment Watches' standard commission terms, with pricing agreed upon in advance with the portfolio owner.

- Opt to extend the investment period for the portfolio.

- Retain the watches for personal use or further investment.